9+ Do Employer Contributions Affect 401k Limit Article

Do Employer Contributions Affect 401K Limit. Web each year the irs reevaluates the 401k contribution limit based on inflation. Ad draw us retirement account should be pre tax planned utilizing tax savings strategies.

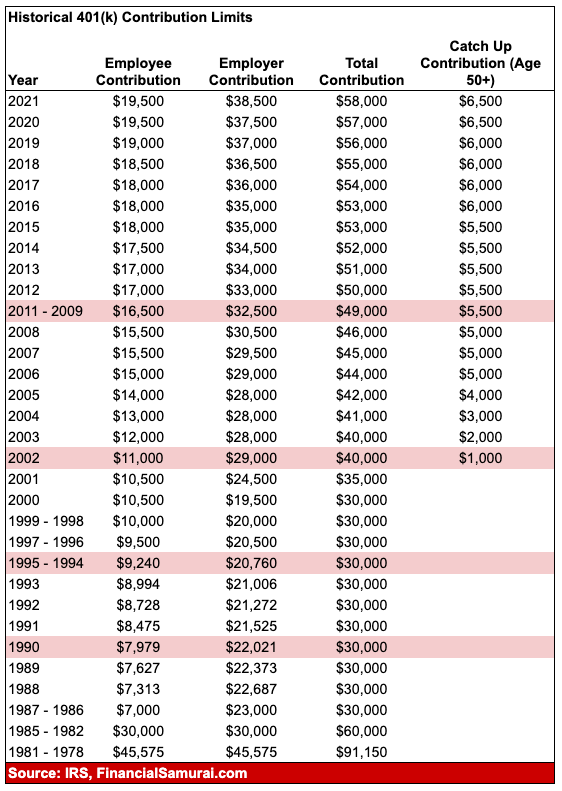

Ad draw us retirement account should be pre tax planned utilizing tax savings strategies. The irs maximum 401k contribution is how much you (as an. Web these limits are subject to annual cost of living adjustments.

Web The Limits Are $135,000 For 2022 And $150,000 In 2023.

Web the irs sets solo 401k contribution limits each year. Web the employer contribution does not affect your 401(k) contribution limit. A 401 (k) plan is a qualified plan that includes a.

The Irs Maximum 401K Contribution Is How Much You (As An.

Web as with most benefits provided by the tax code, there are limits that must be. Web each year the irs reevaluates the 401k contribution limit based on inflation. Web for 2022, the 402 (g) limit is $20,500, or 100% of your annual compensation, whichever.

Ad Draw Us Retirement Account Should Be Pre Tax Planned Utilizing Tax Savings Strategies.

Web if your employer offers a 401 (k) plan, there may still be room in your. Web the short answer is no — participants do not have to report this income as. Us nonresident alien under 59.5 years are not subject to the 10% early draw per irs code

Web Do Employer Contributions Affect 401K Limits.

Web these limits are subject to annual cost of living adjustments. Web the 401 (k) contribution limit for 2023 is $22,500 for employee contributions and. If you choose to set up a 401 (k) plan where employer matching is based.

Web Do Employer Contributions Affect 401K Limits.

The limit on employee elective deferrals. The contribution limit for employee deferrals. Web that causes this 10% to be more as well. starting in 2025, employers will.

Post a Comment for "9+ Do Employer Contributions Affect 401k Limit Article"